How the PPM, Subscription Agreement, and Operating Agreement Work in Concert

June 2022

Knowing how all the agreements work together and what they mean for investor commitment is crucial

▂▂▂▂▂▂

The Private Placement Memorandum (PPM)

The first document an investor usually receives after the initial presentation deck is the Private Placement Memorandum. This document may chiefly follow this general outline:

Disclaimer

Summary of Investment

Further Disclaimers on future looking investments and risk

Overview of equity investment needed, description of property, how it will be managed

Summary of how the general partner/sponsor will be paid as well as general description of how free cash flow will be distributed to limited partners

Further explanations of investment and operating risks, as well as special risks like taxes and future law changes

Delineation of how raised funds are to be used, including upfront fees

Indemnification section about standard of care from General Partner

Instructions for interested parties to review all other legal documents, such as Operating agreement, Subscription agreement, and others

Optional Exhibits: Operating Agreement, Investor Questionnaire, Subscription Agreement, Executive summary (presentation deck), Lease agreements, etc.

The PPM is an important document by how it lays the initial foundation of legality and risk disclaimers. It also sets the initial expectation of the formation and management of the investment company, the property in question, and how money will flow to investors and general partners. When an investor desires to move forward with the investment, they move onto the other legal agreement documents.

The Subscription Agreement

The investor may move onto the Subscription Agreement (SA) next. This document repeats briefly some of the summary information of the PPM, namely the property description, the main parties of the management company, the total equity investment requested, and the purchasable shares.

It is at this point in which the SA departs from the PPM. It begins by stating that the undersigned investor agrees to purchase a certain number of shares for a certain investment amount. The document then continues mostly in legal terms:

Reiterating the valid and legal issuance of the shares, the good faith formation of the management company, and other compliance areas.

Allowing the investor to attest their investor qualifications again, that they have applied their own due diligence in this investment, and they understand the risks.

Stating legal applications in the cases of court or enforcement, such as severability, expenses assigned to non-prevailing party, etc.

Lastly, the SA ends with a signature page and the specific investment amount and total shares that the investor elects. The Subscription Agreement may be the most succinct document among the three chief documents in private equity.

The Operating Agreement

If the Subscription Agreement is the most succinct document, then the Operating Agreement is the most detailed. It may be more than 2x the length of the PPM (without its exhibits) and 5x longer than the Subscription Agreement.

The Operating Agreement (OA) is the final binding legal document before the investment and the investment company become final and fully legally binding. As such, it reiterates all the particular facts of the investment already mentioned in the Executive Summary/Presentation deck, PPM, and SA. In fact, an investor could learn all the parts to any of the chief documents by skipping to the OA first.

An OA may follow an outline like the below:

Definitions of legal terms

Description of the organization that will own the property

Detailed rights of all members (Class A/B) in the organization, such as voting rights, voting meetings, etc.

Detailed descriptions of how the company will be managed: duties of the general partners, their restrictions, freedoms, what to do in case of a managerial vacancy, members voting powers, etc.

Capital accounts, methods for returning of initial capital investments, member loans to the company, and capital calls scenarios

Accounting Allocations, distributions of free cash flow across loss or gain scenarios

Transfer of share interest options, right of refusals, new member procedures, etc.

Booking procedures, termination of LLC upon disposition, further legal disclaimers, etc.

Further exhibits, like distribution schedules, names of members, and percentage interests

For an OA to address in detailed fashion the myriad scenarios that may arise during the investment, the document tends to be 35 pages or more. It is the senior document for the investment, one that will be reference most commonly throughout the life of the company. One can think of the OA as the summation of the Executive summary, PPM, and SA, and its own specific operating procedures for the likely and not-so-likely events that may come, like a manager passing away, a limited partner selling their interest, capital calls, and negative cash flow accounting and allocation.

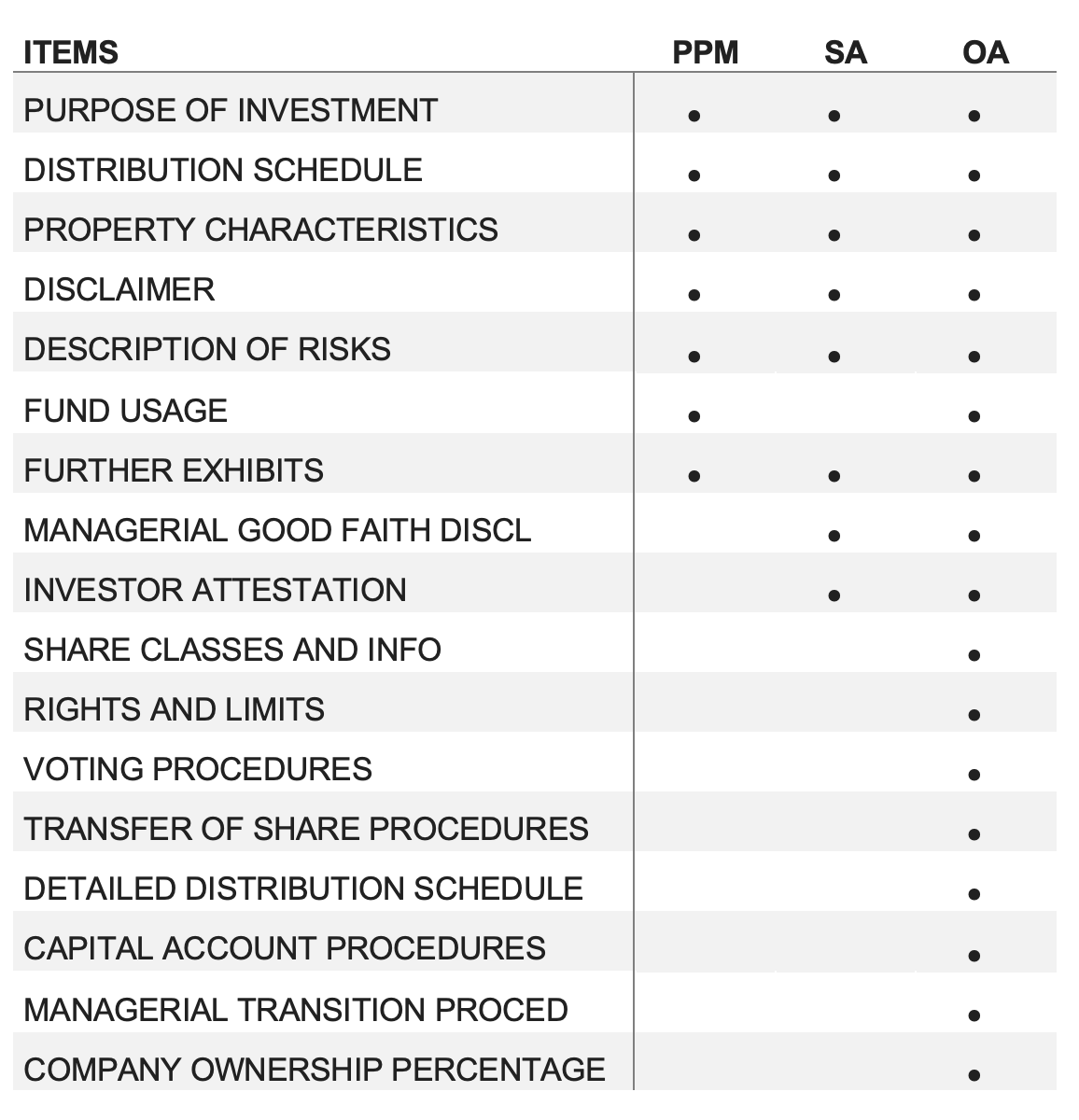

Another way to visualize the three leading documents in private investments, below is a table (not all inclusive) that compares the three.